This can help you create a realistic budget and avoid taking on more debt than you can handle. Helps you plan your budget: Navy Federal auto loan calculator can help you estimate your monthly payments, which can give you a clear idea of how much you can afford to spend on a car.You can try it here Using the Navy Federal auto loan calculator can provide several benefits You can also experiment with different down payment amounts to see how they affect your total loan amount and monthly payments. Try out different loan amounts, terms, and interest rates to see how they affect your payments. Once you have this information, you can use a car loan calculator to estimate your monthly payments.

NAVY FED CAR LOAN CALC REGISTRATION

You should also factor in any additional costs such as taxes, registration fees, and insurance. You can use websites such as Kelley Blue Book or Edmunds to find out the average price of the car you’re interested in. Next, decide on the type of car you want to buy and research its cost. Review your credit report carefully to check for errors or discrepancies that could affect your credit score.

NAVY FED CAR LOAN CALC FREE

You can get a free credit report from each of the three major credit bureaus once a year at. Start by checking your credit score, which is a key factor in determining your interest rate and loan terms. However, using a car loan calculator can give you a general idea of what your payments will be and help you make informed decisions about your car financing.īefore using a car loan calculator, it’s a good idea to gather some information about your car financing options. Your actual monthly payment may vary based on factors such as your credit score, down payment, and loan term.

When using an auto loan calculator, it’s important to keep in mind that the estimate is just that – an estimate. By using your credit union’s auto loan calculator, you can better understand your monthly payments and make a more informed decision about your car financing. They may also offer additional features such as a payment schedule, payment frequency options, and a loan prepayment calculator. Many credit unions offer online calculators that allow you to estimate your monthly payments based on your loan amount, term, and interest rate. If you’re a member of a credit union, you can also use an auto loan calculator from your credit union. You can also adjust the calculator to see how your loan amount, term, or interest rate changes can affect your monthly payments.

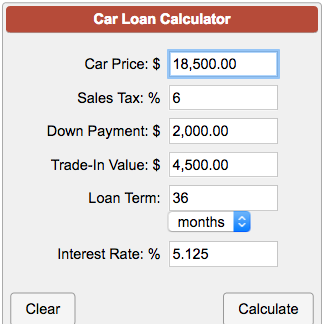

The calculator will then generate an estimate of your monthly payment and the total interest you’ll pay over the life of the loan. To use the Navy Federal auto loan calculator, simply enter your loan amount, term, and interest rate. By using this tool, you can determine how much you can afford to borrow and make informed decisions about your car financing.

You can also use it to calculate your monthly payments for a used car loan. The Navy Federal auto loan calculator is a popular tool that allows you to estimate your monthly payments based on your loan amount, term, and interest rate. Many credit unions and banks such as Navy Federal Credit Union offer online calculators that can help you estimate your car loan payments and compare different financing options based on your budget and credit score. Using the Navy Federal auto loan calculator can provide several benefitsĪre you in the market for a new or used car and need to find an affordable financing option? One way to determine your monthly payments, interest rates, and total costs over the life of your loan is by using a Navy Federal auto loan calculator.

0 kommentar(er)

0 kommentar(er)